【Petroleum Coke】Market Outlook After Dragon Boat Festival: Weak and Stable,... (Part I)

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Market Outlook After Dragon Boat Festival: Weak and Stable, Prices May Fluctuate Between 1300–3400 RMB/Ton! (Part I)

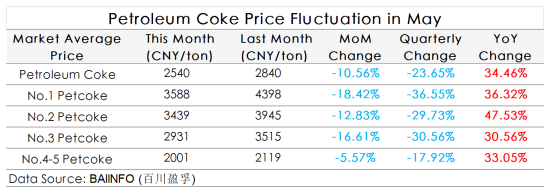

In May, overall market activity was moderate, with prices under pressure and trending downward. Pre-holiday restocking was limited, and downstream sentiment remained cautious.

The average petroleum coke price in May was 2,540 RMB/ton, down 300 RMB/ton from last month, a drop of 10.56%.

In Shandong's independent refineries, the average market price was 2,212 RMB/ton, down 213 RMB/ton from last month, a decrease of 8.77%.

During the May Day holiday, expectations of eased China–U.S. tariff tensions and low early-month downstream inventories briefly lifted the market. However, after short-term restocking, caution returned, and the market began to decline. From mid- to late May, the market remained under pressure amid strong wait-and-see sentiment.

Major Refinery Performance

State-owned refiners faced weak demand. Low-sulfur petroleum coke prices declined, dragged down by sluggish demand from end-users (e.g., low electric arc furnace operating rates).

Sinopec refineries: Mostly lowered prices; a few made small increases, ranging from 40 to 1,130 RMB/ton.

In the Yangtze River area, negative electrode demand remained weak:

Jiujiang Petrochemical: -180 RMB/ton

Wuhan Petrochemical: -570 to -610 RMB/ton

Jingmen Petrochemical: -450 RMB/ton

In East China: overall price reduction of 60–490 RMB/ton

In North China:

Cangzhou refinery: -580 to -630 RMB/ton

Luoyang Petrochemical: -400 to -600 RMB/ton

In Shandong: Qingdao Petrochemical and Qingdao refinery: -60 to -460 RMB/ton

In South China: Guangzhou Petrochemical: -60 to -340 RMB/ton

PetroChina refineries: Price cuts ranged from 310 to 1,000 RMB/ton.

Northwest: -350 to -550 RMB/ton

Northeast: general reduction of 600–1,000 RMB/ton

North China: Dagang Petrochemical: -900 RMB/ton

Southwest: Yunnan Petrochemical: -310 RMB/ton

CNOOC refineries: Declines of 540–1,050 RMB/ton

Independent Refinery Performance

Independent refineries saw fluctuating declines, ranging from 30 to 550 RMB/ton.

Average price in Shandong was 2,212 RMB/ton. Some refineries saw improved sales after price cuts, but overall remained weak due to negative pressure from major refiners.

Shandong prices:

1) 2A grade: 3,394 RMB/ton

2) 3B grade: 2,832 RMB/ton

3) 3C grade: 2,654 RMB/ton

4) 4A grade: 1,819 RMB/ton

5) 4B grade: 1,434 RMB/ton

Low-sulfur coke dropped by 594 RMB/ton MoM (−14.89%), medium-sulfur coke dropped by 12–57 RMB/ton, and high-sulfur coke showed mixed changes (up or down 20–127 RMB/ton).

Key Influencing Factors Analysis

Supply Side: Steady with Expected Growth

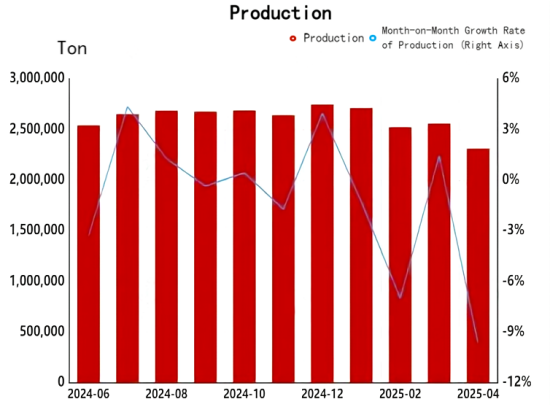

In early May, refineries that were previously shut down for maintenance resumed operations, leading to an increase in domestic supply.

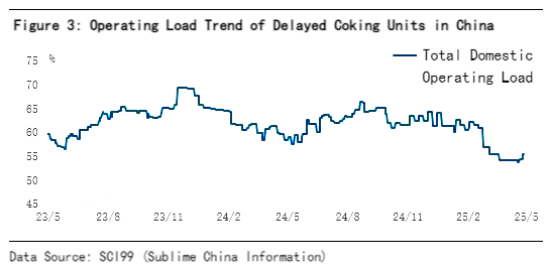

1) National coking operating rate reached 61.31%, up 2.12% from last month.

2) Daily national petroleum coke output stood at 79,080 tons.

3) Independent refinery coking operating rate was 59.43%, up 1.17% from last month.

4) Daily petroleum coke output from independent refineries was 32,390 tons.

In Shandong, May output totaled 626,300 tons, a month-on-month increase of 5,500 tons (+0.89%).

In May, four new coking units were shut down for maintenance, while seven previously shut units resumed production. A total of four independent refineries in Shandong were involved in either restarting or halting operations.

Looking ahead to June, eight coking units are expected to restart, adding 5,700 tons/day of output, while six units are scheduled for maintenance, cutting 5,500 tons/day. Overall, domestic supply is expected to remain relatively stable.

Tariff Policy Changes Between China and the U.S.

China has adjusted tariffs on U.S.-origin petroleum coke, reducing the cumulative tariff from 125% to a combination of 3% base tariff + 10% additional tariff, significantly lowering import costs.

The U.S. is China's largest source of petroleum coke imports, accounting for approximately 30% of total imports.

It is expected that from June to August, monthly imports from the U.S. will recover to about 350,000 tons.

In April 2025, China imported 1.8231 million tons of uncalcined petroleum coke, up 62.02% MoM.

From January to April 2025, total imports reached 5.3424 million tons, an increase of 1.9% YoY.

In May, imports are expected to decrease slightly MoM due to some early cargoes arriving in advance under the old tariff.

In June, estimated petroleum coke imports are around 800,000 tons, with port activity mainly focused on digesting existing inventory.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies