【Calcined Petroleum Coke】Narrow Cost Fluctuation, Severe Profit Loss for CPC Producers

【Calcined Petroleum Coke】Narrow Cost Fluctuation, Severe Profit Loss for Calcined Petroleum Coke Producers

Introduction: Since the beginning of 2025, the calcined petroleum coke market has remained largely unprofitable. On one hand, raw petroleum coke prices surged at the start of the year, sharply increasing downstream production costs. On the other hand, the graphite electrode and graphite cathode markets show low enthusiasm for production and sales, with terminal operating rates remaining low, making it difficult for enterprises to ensure production profitability. Although the anode material market maintains relatively stable production and sales, strict profit controls by aluminum smelters lead to poor profit margins in intermediate links, resulting in calcined petroleum coke producers operating at a loss.

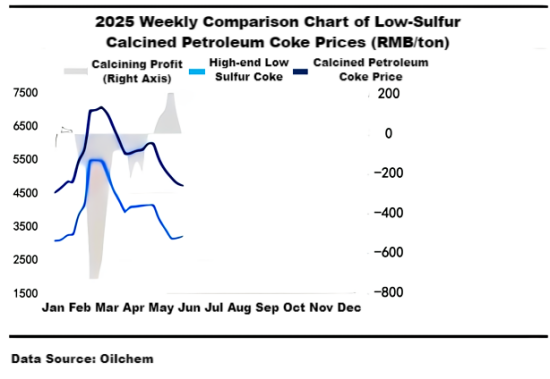

1. Low-sulfur calcined petroleum coke theoretical profit turns negative,

with a 111% month-on-month decline

Entering this year, low-sulfur coke prices have undergone several reductions. Calcined petroleum coke prices followed the cost trend downward, with ordinary-grade products falling to 4,200 RMB/ton, down 1,000 RMB/ton from the previous month, a decrease of 18.86%. High-quality products fell to 5,300 RMB/ton, down 700 RMB/ton month-on-month, a decrease of 11.66%.

This month, the theoretical profit for high-quality calcined petroleum coke stands at -10 RMB/ton, down 100 RMB/ton from last month, a drop of 111.11%. Ordinary-grade profit is -355 RMB/ton, up 31.48% from the previous month. Despite a slight recovery in ordinary-grade profitability, theoretical profits remain in negative territory.

In actual production, due to weak demand from the graphite electrode and carburant markets, and with electric arc furnace operating rates still declining, calcined petroleum coke remains difficult to sell. Even with improved theoretical profit, factories lower prices to boost sales, resulting in continued poor actual profitability.

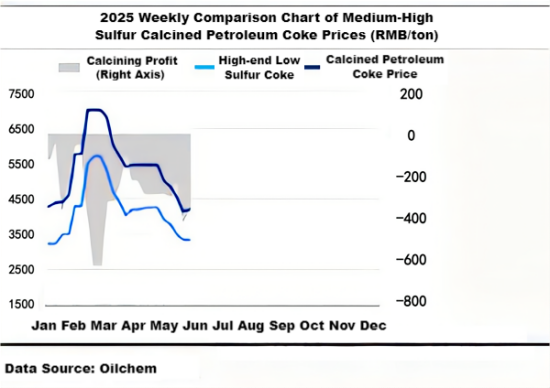

2. Mid-sulfur calcined petroleum coke profits remain poor,

still in negative territory

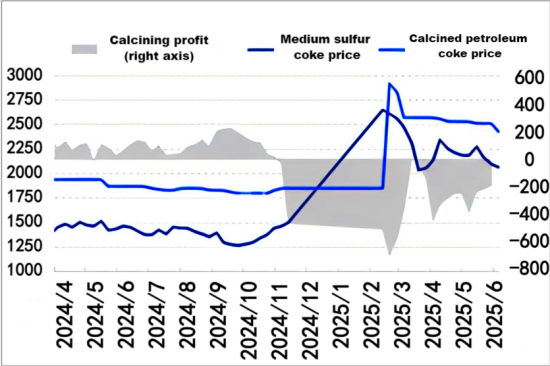

Chart 3: 2025 High-Quality Low-Sulfur Calcined Petroleum Coke Theoretical Profit Trend (RMB/ton)

In the first half of the year, refinery mid-sulfur regular petroleum coke prices rose and then fell. Calcined petroleum coke prices followed suit, currently down to 2,500 RMB/ton for products with 3.0% sulfur. Downstream purchasing sentiment remains lukewarm, raw material prices fluctuate, and the market overall remains stable.

From the beginning of the year to now, theoretical profit for mid-sulfur calcined petroleum coke has consistently remained negative. Although there was a brief recovery in mid-March, it lasted only a week before falling below cost again. As of this report, the lowest point for mid-sulfur calcined petroleum coke was in mid-February at -678 RMB/ton.

The primary cause is the completion of a new round of stockpiling in the anode materials market, coupled with poor profitability in the anode sector, which dampens demand for calcined petroleum coke. Prices continue to drop, driving profits to record lows. Currently, mid-sulfur calcined petroleum coke theoretical profit stands at -184 RMB/ton.

3. Cost-side Advantage: Delayed Coking Maintains High Profit Margins

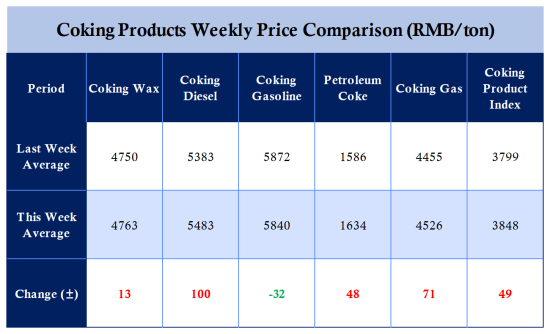

Table 1: Comparison of Coking Products

This cycle, the theoretical processing profit for delayed coking units at Shandong local refineries is 247 RMB/ton, an increase of 71 RMB/ton from the previous cycle’s 176 RMB/ton, a rise of 40.34%.

Diesel weekly average price rose 100 RMB/ton to 5,483 RMB/ton; gasoline fell 32 RMB/ton to 5,840 RMB/ton. Coking wax oil average rose 13 RMB/ton to 4,763 RMB/ton. Petroleum coke average rose 48 RMB/ton to 1,634 RMB/ton. On the feedstock side, the average price for coking feedstock dropped 25 RMB/ton to 3,900 RMB/ton. Overall, coking profits rose compared to the previous cycle.

4. Anode Profits Recover This Month, Up 384% MoM

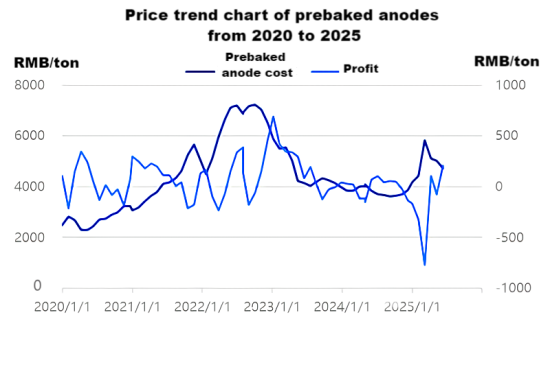

Chart 4: Prebaked Anode Market Profit Trend

As the chart shows, theoretical profits for the prebaked anode market have returned to above the breakeven line. This month, calculated profit is 212 RMB/ton, up 286 RMB/ton from last month, an increase of 384%.

The main reason is a sharp drop in raw material prices, while the anode pricing mechanism follows the m-1 principle. Previously, there was a discrepancy between set anode prices and actual calculated prices. As prices aligned this month and with weak cost support, theoretical profitability returned to positive territory.

Summary:

Whether from the raw material side or downstream demand side, while theoretical profits show signs of recovery, actual profit margins are largely absorbed by upstream petroleum coke and downstream prebaked anode markets. As a middle link, calcined petroleum coke producers still face slim profits. This situation is expected to persist in the short term.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies