Analysis of current situation and pattern of artificial graphite industry

Analysis of current situation and pattern of artificial graphite industry

Shipments are rising but the market is still under supply and demand pressure

1. Manufacturing costs

According to the "China artificial graphite Industry development Status Analysis and Future Investment Research Report (2022-2029)" released by the INSIGHT AND INFO network, the process of artificial graphite is complex and needs to be produced through raw material pretreatment, granulation, graphitization, to the finished product screening and other processes. Graphitization processing is the most important production link. Increasing the proportion of graphitization self-supply can significantly reduce the production cost. Graphitization is a high-temperature treatment method. The higher the thermal temperature is, the greater the graphitization degree is. However, it is extremely power consuming and belongs to high energy consumption production link. The graphitization cost is the highest in the artificial graphite processes, accounting for about 60% of artificial graphite manufacturing cost.

2. Shipment volume

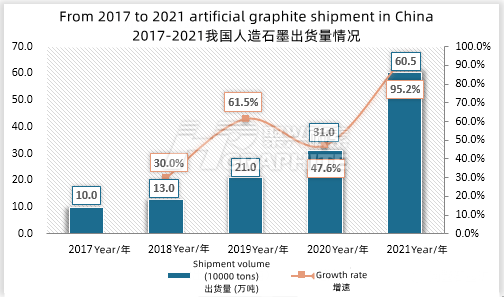

Artificial graphite is better than natural graphite in cycle performance, safety performance and charge-discharge ratio. It has become the main anode material and is mostly used in power batteries and medium and high-end consumer lithium batteries industries. With the sharp increase in the downstream demand for new energy vehicles, China's artificial graphite shipments are also rising. From 2017 to 2021, the shipment increased from 100,000 tons to 605,000 tons, an increase of 295,000 tons compared with 2020, with a year-on-year growth rate of 95.2%, and the shipment nearly doubled. However, there is still pressure on supply and demand in the domestic graphite market. Recently, the supply and demand atmosphere is more tense, and the gap is widening again. The anode material enterprises begin to choose graphitization OEM to increase capacity.

The overall perspective on the shipment structure of lithium battery anode material product segments, although the proportion of various types of anode materials is constantly adjusted, artificial graphite is the mainstream of the market, and the market share is rising. From 2019 to 2021, the market share increased from 78.5% to 83.6% and then to 84.0%, gradually and steadily accounting for more than 80% of the market share.At present, the new energy automobile industry continues to be highly prosperous, and the scale of the artificial graphite industry will continue to expand in the future.

3. Price

In 2021, under the "double carbon" policy, anode materials enterprises carried out environmental protection production, in addition, the outbreak of market demand, resulting in a tight supply and demand of anode materials. The average price of natural graphite and artificial graphite increased by different ranges compared with the previous year, reaching 35000 yuan/ton and 50000 yuan/ton respectively. Artificial graphite production links are various, and the production cost is high, resulting in higher average price than natural graphite. For more information and analysis of graphite industry, please contact us.

No related results found

0 Replies