【Petroleum Coke & Needle Coke】How is the trend in November?

【Petroleum Coke & Needle Coke】How is the trend in November?

Carbon Market Brief

The carbon industry is a vital raw material industry in the country. Due to its excellent properties, it serves as a unique material in many special fields, irreplaceable by any other metal or non-metal materials. It is a typical circular economy industry, widely used in metallurgy, chemical industry, machinery manufacturing, aerospace, wind and solar energy, nuclear power, and other sectors.

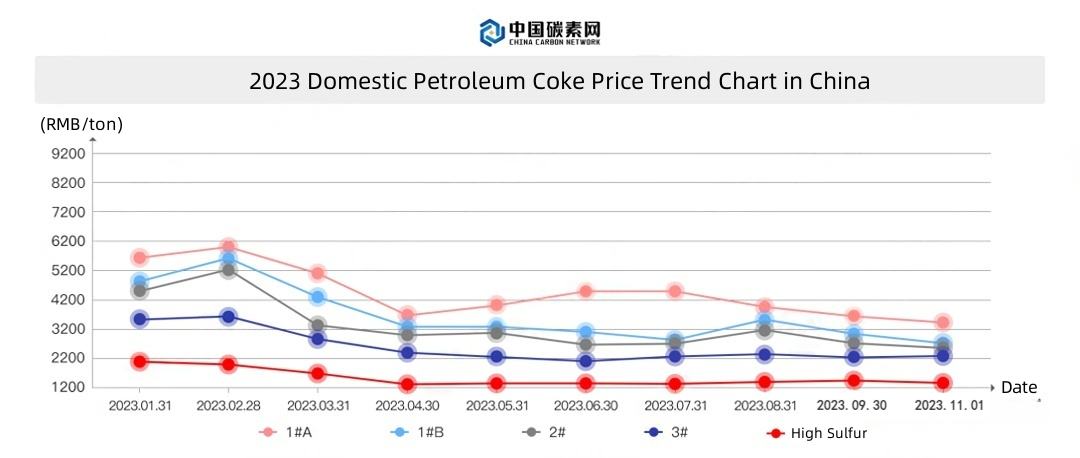

01. Petroleum Coke

In October, China domestic petroleum coke market prices showed an overall downward trend. The main low-sulfur calcined petroleum coke (CPC) market saw a slowdown in shipments, leading to a reduction in coke prices. Prices of petroleum coke from local refineries underwent slight fluctuations and declines. The average price of low-sulfur petroleum coke in the northeastern region dropped to 3,122 yuan/ton. Regarding supply, in mid-October, some domestic petroleum coke refineries underwent maintenance and adjustments, resulting in a slight decrease in market supply. On the demand side, the operating rates of downstream carbon enterprises decreased in October, leading to reduced demand. This, in turn, caused a decline in profits for calcined petroleum coke and anodes. The pre-baked anode market maintained stable monthly procurement benchmark prices as a transitional phase. The graphite electrode market had reasonable trading, with a general demand for petroleum coke on the negative electrode material side. Overall, the main contradiction in the domestic petroleum coke market in October remained supply and demand.

November Forecast:

On the supply side, in November, some petroleum coke enterprises may reduce production due to profit reduction. Domestic petroleum coke supply may slightly decrease. In addition, for port petroleum coke, the import volume of petroleum coke may decrease, but domestic port petroleum coke inventories are still in the process of gradual destocking. On the demand side, the demand for petroleum coke downstream may decrease, especially in the southwestern region, where aluminum electrolysis may experience a significant decline. Additionally, environmental impacts may lead to production reductions in the northern carbon industry. It is expected that the domestic petroleum coke prices may continue to decline in November.

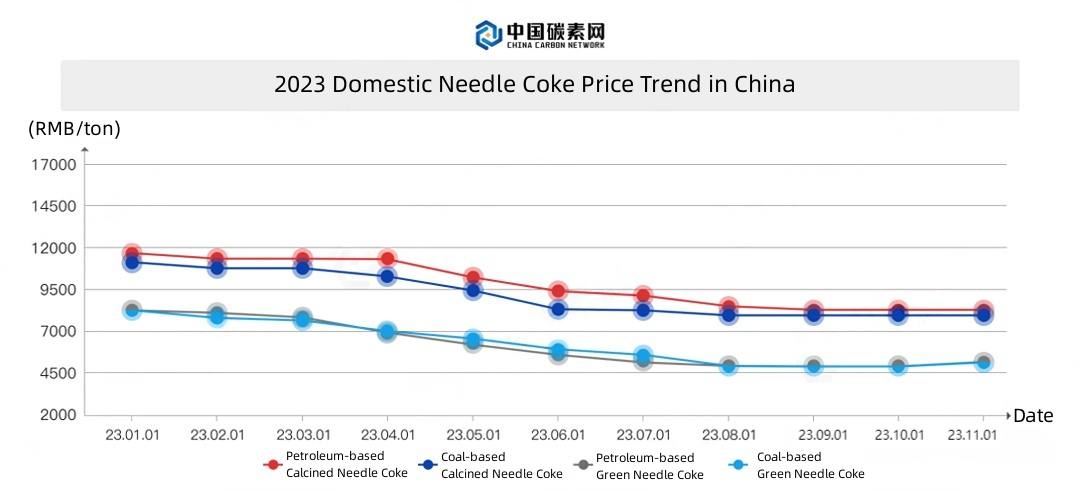

02. Needle Coke

In October, China domestic needle coke market prices remained relatively stable, with some minor upward adjustments, but not significant. In October, the average price for petroleum-based green coke was 5,170 yuan/ton, and coal-based green coke was 5,095 yuan/ton, both showing slight increases compared to September. The average price for petroleum-based calcined petroleum coke was 8,375 yuan/ton, and coal-based calcined petroleum coke was 8,000 yuan/ton, maintaining stable operation compared to September.

November Forecast:

It is expected that in November, there will be no substantial positive factors for downstream market demand. The pressure on needle coke shipments will persist, and due to cost and profit factors, needle coke prices will remain relatively stable. Feel free to contact us for daily updates on the petroleum coke market and stay informed about the latest trends.

No related results found

0 Replies