【Petroleum Coke】Outlook on the Domestic Market Supply and Demand in 2024

【Petroleum Coke】Outlook on the Domestic Market Supply and Demand in 2024(20231208-1214)

In 2023, the petroleum coke market in China continued to experience ample supply, and prices entered a phase of downward consolidation due to general support from downstream demand. The frequent adjustments in domestic petroleum coke indicators, uneven resource structures, and the impact of multiple bearish factors have led to continuous price declines. Graphitized petroleum coke is used as carburants in metallurgy, casting, and precision casting.. What kind of development stage will the supply and demand situation in the petroleum coke market enter after the cold wave?

I. Outlook on the Supply Side of the Petroleum Coke Market

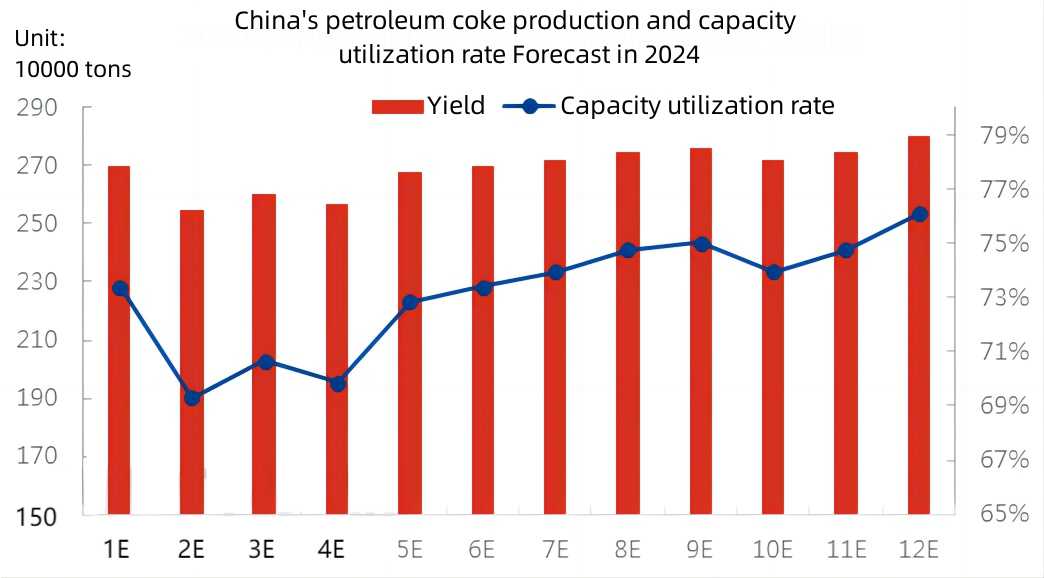

Looking ahead to 2024, there are plans for the construction of delayed coking units in China, including the second phase of the 3 million tons/year delayed coking unit in Guangdong Petrochemical's integrated refining and chemical project. Other refinery delayed coking units currently have no plans for withdrawal or addition, and domestic delayed coking unit capacity may continue to grow slightly.

Source: Oilchem

Market research reveals that the second quarter of each year is traditionally the peak season for major repairs of domestic delayed coking units. Therefore, the production of petroleum coke generally begins to decline from February and gradually recovers from late May. As some refineries have planned comprehensive maintenance in the third quarter, the growth rate of domestic petroleum coke supply may slightly slow down, and monthly production of petroleum coke may decrease towards the end of the third quarter. Additionally, there is less maintenance of delayed coking units at domestic refineries in 2023. Regarding the main operation, 2021 was a major year for unit maintenance. The next concentrated unit maintenance period is expected to occur in 2024, so the impact of refinery delayed coking unit maintenance on production may be relatively greater than in 2023.

II. Outlook on the Demand Side of the Petroleum Coke Market

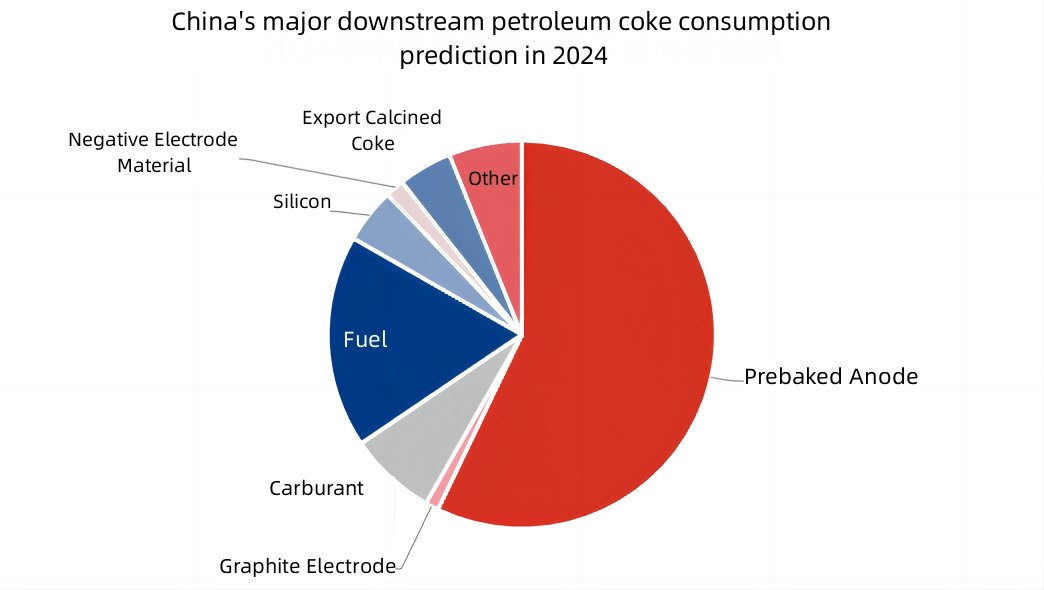

Looking at the development of the entire downstream sectors of petroleum coke in 2023, the demand for petroleum coke in traditional carbon markets remained stable, while the usage in the new materials market continued to increase, entering a new stage of development for the petroleum coke demand side.

Source: Oilchem

It is expected that the usage of petroleum coke in the fields of prebaked anodes and graphite electrodes will remain relatively stable in 2024. The self-use of petroleum coke as fuel in integrated refineries may increase, and there may be additional demand in the fields of negative electrode materials and carbon additives. However, due to the weakening market conditions, the overall demand growth rate may slow down. The apparent consumption of petroleum coke in China in 2024 may show a small fluctuation trend. Overall, due to factors such as equipment maintenance, the apparent consumption of petroleum coke in the first half of the year is expected to be better than in the second half. Therefore, the supply and demand gap for petroleum coke in the first half of 2024 may be reduced.

III. Outlook on the Price Trend of Petroleum Coke

Source: Oilchem

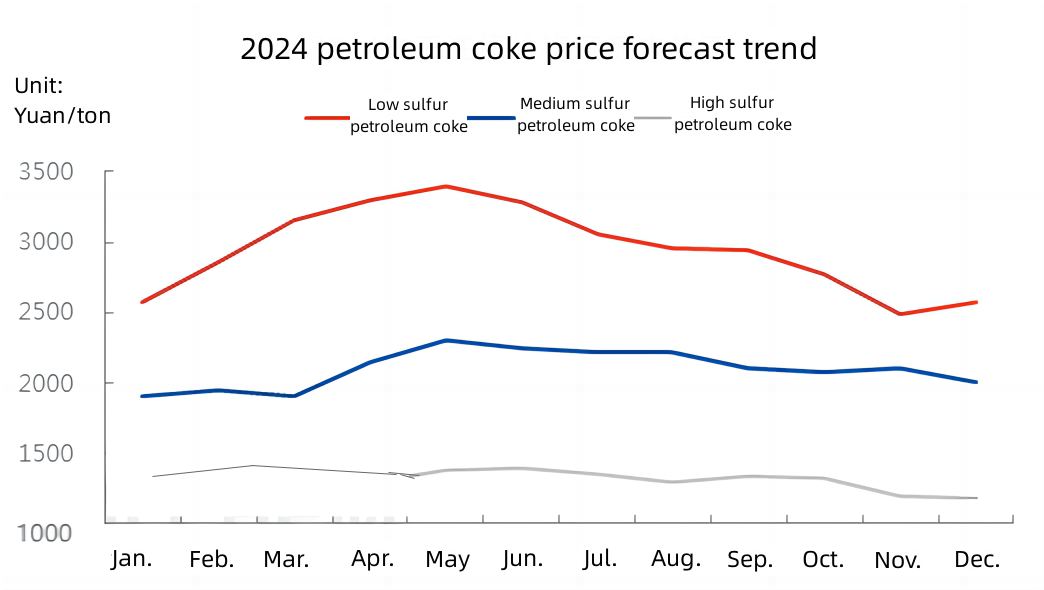

The supply of low-sulfur coke is relatively stable, and the carbon market for steel continues to be weak, with low operating loads. In the negative electrode material field, the demand for petroleum coke driven by just-in-time purchasing remains weak, and the overall demand for low-sulfur coke in traditional industries is not conducive to supporting price increases. The continuous release of capacity in the new materials market results in a significant increase in demand for low-sulfur resources, gradually tilting low-sulfur resources toward the new materials market. It is expected that the price of low-sulfur coke in 2024 may remain in the range of 2,500-3,500 yuan/ton.

The fluctuation of trace element indicators has become an increasingly influential factor in pricing medium-sulfur coke. The demand support for medium-sulfur coke in the domestic aluminum carbon market still exists, and with the incremental demand for medium-sulfur coke from new prebaked anode companies that have recently started production, there will be a resource competition between prebaked anodes and negative electrodes. This favors an increase in prices. The increased demand in the field of negative electrode filler materials may positively boost the outbound shipments of medium-sulfur ordinary petroleum coke, but due to the increased supply of ordinary resources, there is limited room for overall adjustments in petroleum coke prices. It is expected that the price of medium-sulfur petroleum coke will fluctuate and adjust within the range of 1,800-2,500 yuan/ton.

The domestic high-sulfur petroleum coke market is expected to be relatively weak. The continuous increase in domestic production of high-sulfur coke resources, coupled with the high overlap between imported coke at ports and domestic high-sulfur coke resources, has resulted in sufficient supply of high-sulfur coke. Looking ahead to 2024, high-sulfur coke with good trace elements supported by demand in the aluminum carbon market may still remain at relatively high levels. However, high-sulfur coke with poor trace elements, apart from self-use by refineries, is mainly used in the fields of silicon enterprises and fuel, with limited positive impact on the demand side. The overall weak market conditions may lead to a limited downward adjustment in petroleum coke prices, and the price of high-sulfur petroleum coke may remain weakly volatile. Feel free to contact us to learn about the latest reports on the petroleum coke industry.

No related results found

0 Replies