【CPC】Demand Support Mainly; Calcined Petroleum Coke Price is Temporarily Stable in Transition

【CPC】Demand Support Mainly; The Market Price

of Calcined Petroleum Coke is Temporarily Stable in Transition

1.Current Focus

Wuhai Yangguang Carbon Co., Ltd.'s annual production of 100,000 tons calcined material project has passed the environmental impact assessment. The project is located in Wuda Industrial Park, Wuhai High-tech Industrial Development Zone, Inner Mongolia. It is a reconstruction and expansion project. After completion, it will produce 100,000 tons of calcined material annually, including 6,000 tons/a of electrically calcined coal (calcined), 4,000 tons/a of general calcined coal (calcined), and 90,000 tons of petroleum coke (calcined).

2.Current Market

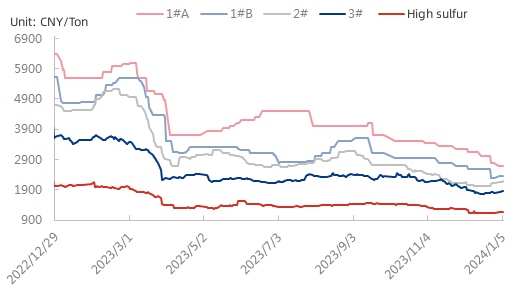

China's Petroleum Coke Price Trend

Source: Oilchem

Currently, China's domestic calcined petroleum coke (CPC) market is actively traded. calcined petroleum coke made from Jinxi coke is priced at 3400-3600 CNY/ton, and the price is stable in transition. The production of low-sulfur coke in Northeast China has decreased, and the market price of calcined petroleum coke has been boosted. The market price of medium and high sulfur calcined petroleum coke is 1700-2350 CNY/ton. Manufacturers of medium and high sulfur calcined petroleum coke have a good production and sales, and the demand side is mainly for just-in-time purchasing. The market price is temporarily stable in transition.

3. Calcined petroleum coke Production and Sales Dynamics

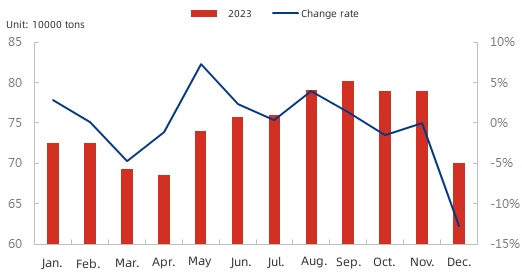

Calcined Petroleum Coke Monthly production trend

Source: Oilchem

In December, China's domestic production of petroleum coke was 700,000 tons, a month-on-month decrease of 90,000 tons or 11.39%.

4.Related Product Situation

The spot price of electrolytic aluminum remains high and fluctuates, and the market support for carbon used in aluminum is still good. Downstream anode plants have a certain market entry, maintaining just-in-time purchasing, providing support for the shipment of index coke. The market support for negative electrode materials is general, and the entry sentiment of the demand side is relatively cautious. The market for carbon used in steel continues to be weak, with limited positive factors driving.

5.Future Forecast

The calcined petroleum coke market is still actively traded, and the inventory situation of enterprises has slightly rebounded. After the rise in the price of low-sulfur calcined petroleum coke, the purchasing enthusiasm on the demand side is general. It is expected that the low-sulfur calcined petroleum coke market will have active shipments in the near future, and the price may have an upward trend. The price of medium and high sulfur regular cargo calcined petroleum coke may remain temporarily stable in transition. The analysis and prediction of the coke industry, feel free to contact us.

No related results found

0 Replies