【Petroleum Coke】Demand Remains Tight, How Will the Carburant Market Perform?

【Petroleum Coke】Demand Remains Tight, How Will the Carburant Market Perform?

Data Source: Oilchem

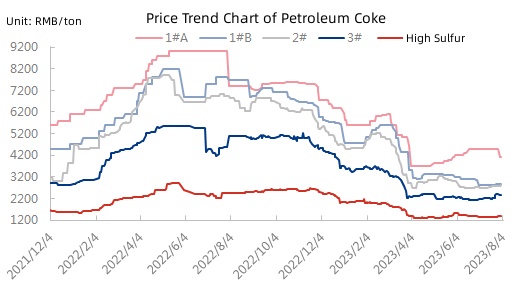

Cost Aspect: As of the time of writing, in the petroleum coke market, the average price of 1# petroleum coke is 3367 RMB/ton, showing a decrease of 308 RMB/ton or 8.38% compared to the previous period. On the other hand, 2# coke is priced at 2686 RMB/ton, representing an increase of 8 RMB/ton or 0.3% from the previous period, to view the production situation of graphitized petroleum coke. Currently, China domestic petroleum coke market maintains reasonable trading activity, with increased enthusiasm from downstream markets for taking deliveries. The production rate of negative electrode materials has also risen, providing favorable support to petroleum coke prices. However, as of the end of July, port inventories continue to accumulate, and the supply of petroleum coke remains high, indicating that the oversupply situation has not been fully alleviated. It is anticipated that the coke price will experience narrow fluctuations in the short term while maintaining stability in the long run. As for calcined coal, the price of raw materials anthracite is rising, with a relatively strong price trend. The increase in price has led to a slight slowdown in downstream transactions, resulting in a relatively stable market with a strong wait-and-see sentiment.

Data Source: Oilchem

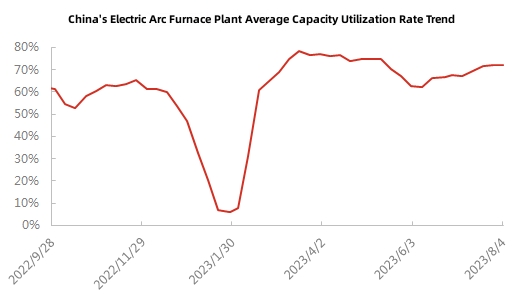

Downstream Demand: Since June, the operating rate of steel mills has been sluggish. Due to low profitability, downstream demand remains cautious, and a strong wait-and-see attitude is prevailing. For the upcoming week, it is expected that some steel mills in the Southwest region will resume production, and a certain electric furnace plant in the Central China Hubei region is also expected to resume production with a daily output of 1000 tons. Overall, the independent electric arc furnace plant's operating rate and capacity utilization rate are expected to experience a slight increase next week.

Data Source: Oilchem

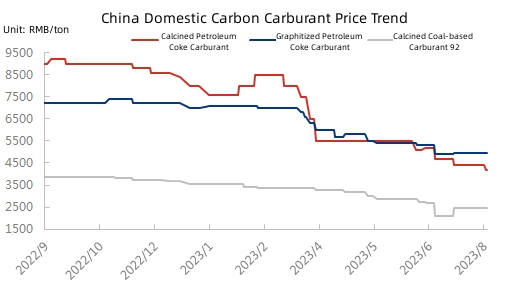

Price Aspect: The market quotation for low-sulfur calcined coke as a carburant is 4200 RMB/ton, showing a decrease of 200 RMB/ton compared to the previous period. The market quotation for graphitized carburant is 4950 RMB/ton, remaining unchanged from the previous period. The market quotation for calcined coal-based carburant ranges from 2090 to 3300 RMB/ton, remaining stable compared to the previous period. The procurement enthusiasm on the demand side is average, and there is a supply-demand imbalance. Within the overall market environment, the real estate industry remains sluggish, limiting the downstream demand for building materials, and steel mills are experiencing low profitability, with some refineries operating at a loss. It is anticipated that in the short term, the carburant market will not witness significant improvement, lacking obvious positive support, and the prices of carburants are likely to continue fluctuating at low levels. Wecome to contact us for more industrial reports on carbon market.

No related results found

0 Replies